Advance Breakout & Breakdown Strategy - Option Trading

Updated at: 28 Feb 2024Deepak PainkraWhen a price hits a certain level multiple times, it gets weak, so in this article, I will walk you through advanced breakout and breakdown strategies.

Advance Breakout & Advance Down Strategy

First, let me walk you through this strategy and try to understand the price behaviour. Also, I have broken down all the price action behaviours for the breakout strategy.

A level gets Weak & Strong While Multiple Test

You will find these price behaviours in trading when a price hits a certain level multiple times, and it gets weak as well as strong at the same time, probably 3 to 4 times retest, then it will give you a strong breakout, you will be able to achieve the bigger target.

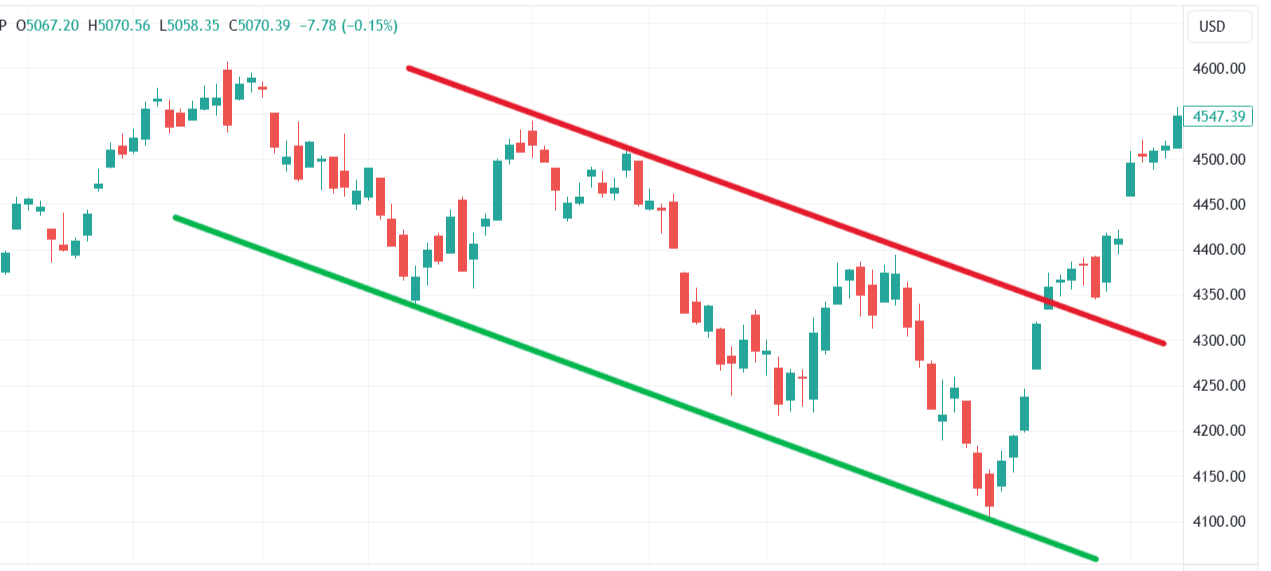

Let me show a live example in the chart pattern so you get to know what I'm trying to say,

You have noticed in the chart pattern. When the price gives a breakdown a second and third time, it finds support, and after multiple retests, a breakout happens, thus how the breakdown works.

Note:- If the level gets multiple time retests, then the level will not act as a support and resistance, and the price will give you a breakout and breakdown.

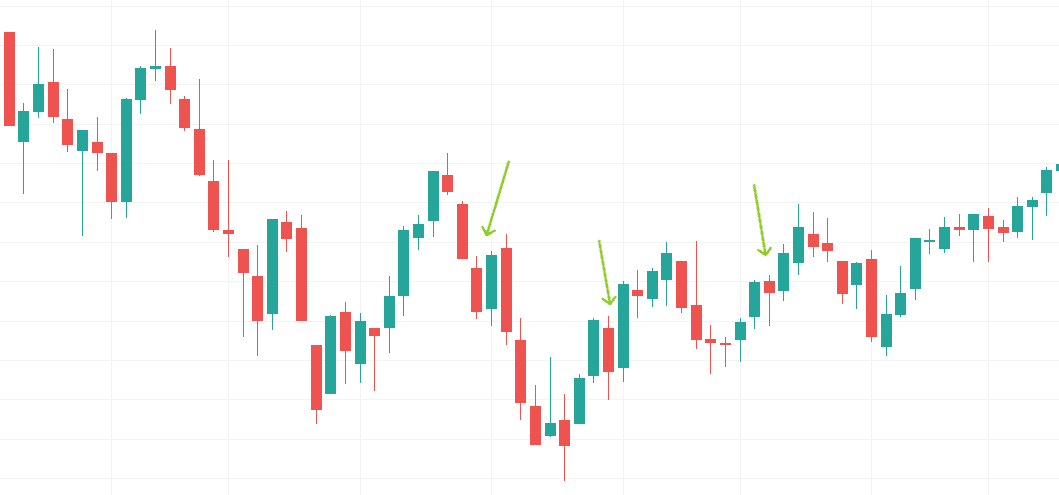

Pause Candle Formation,

After a strong breakout, the market creates a pause candle, or it goes sideways, and here folks get confused and take PUT and CALL options depending upon the market where it's heading, and they make a loss because, after a pause candle, it heads to the right direction.

So, here is the one catch. In this case, if the market has created a pause candle. It also means it's waiting for a breakout because selling is always fast.

Candle Formation is an Alert,

When a particular candle gets formed, wait for breakout and breakdown and not take any position until and unless it breaks its upper and lower parts.

But add proper stop loss because the risk to reward will be the priority, and this is how anyone can trade with candlesticks and chart patterns.

Remember, most strategies have 50-60% accuracy and do not expect much more.

Aggressive in the Second Breakout & Breakdown

When the chart pattern breaks the level a second time, the folks get aggressive because the people who miss the opportunity will be adding their position, and the market will give you a follow-through,

Double Bottom and Double Top are examples of this strategy. The market also creates a pause candle after a breakout and breakdown. Which I talked about earlier.