Best Stop Loss Strategy for Intraday - Option Trading

Updated at: 11 March 2024By Deepak PainkraIn this article, I will walk you through the best stop-loss strategy for options trading, including intraday and position trading, so let's get into it.

The stop loss also depends on the time frame that we are using. If it's a shorter time frame, it will be small, and if you're using a larger time frame, it will be huge.

Let me walk you through the stop-loss strategy on the chart and candlesticks pattern

Stop Loss Strategy for Candlestick Pattern

It depends upon whether you're going long or short. Draw a tradeline on top and bottom of the candlestick pattern, but remember it is just an alert candle.

If you are going long, the lower part will be support, and the upper part will be resistance, and it will be the opposite if you're going short.

Let me walk you through the real example in the chart pattern in the market.

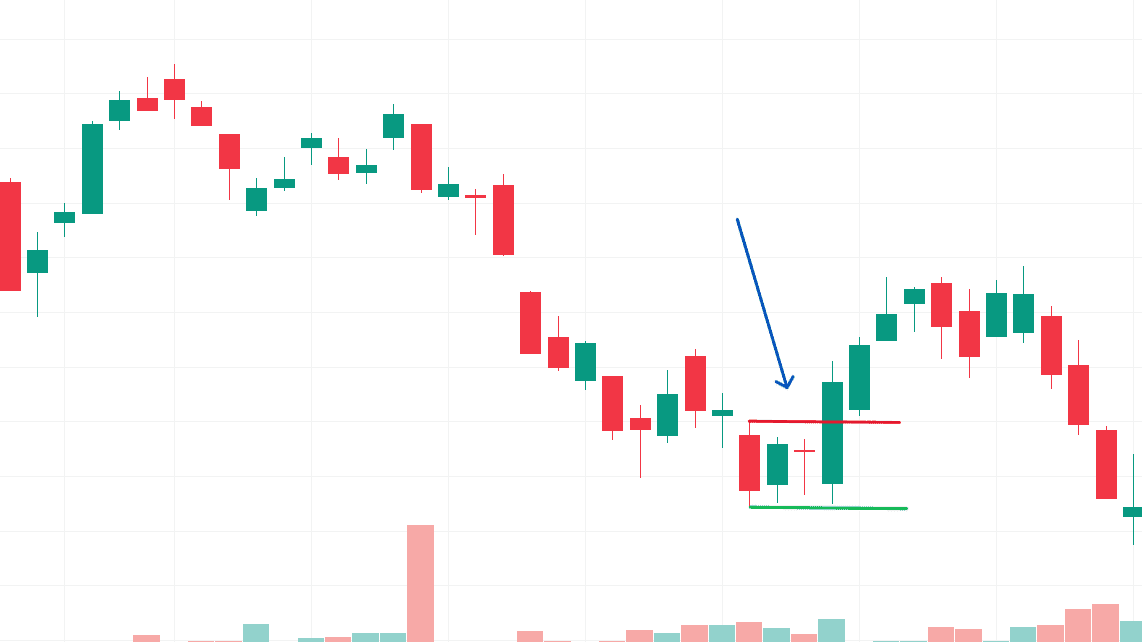

In this chart, we have assumed the red line as a resistance and the green line as a support, and I have taken an example of the mother and baby candle.

Stop loss Strategies for Chart Pattern

You must understand how the support and resistance work. Let's discuss all the scenarios which you might encounter in the market.

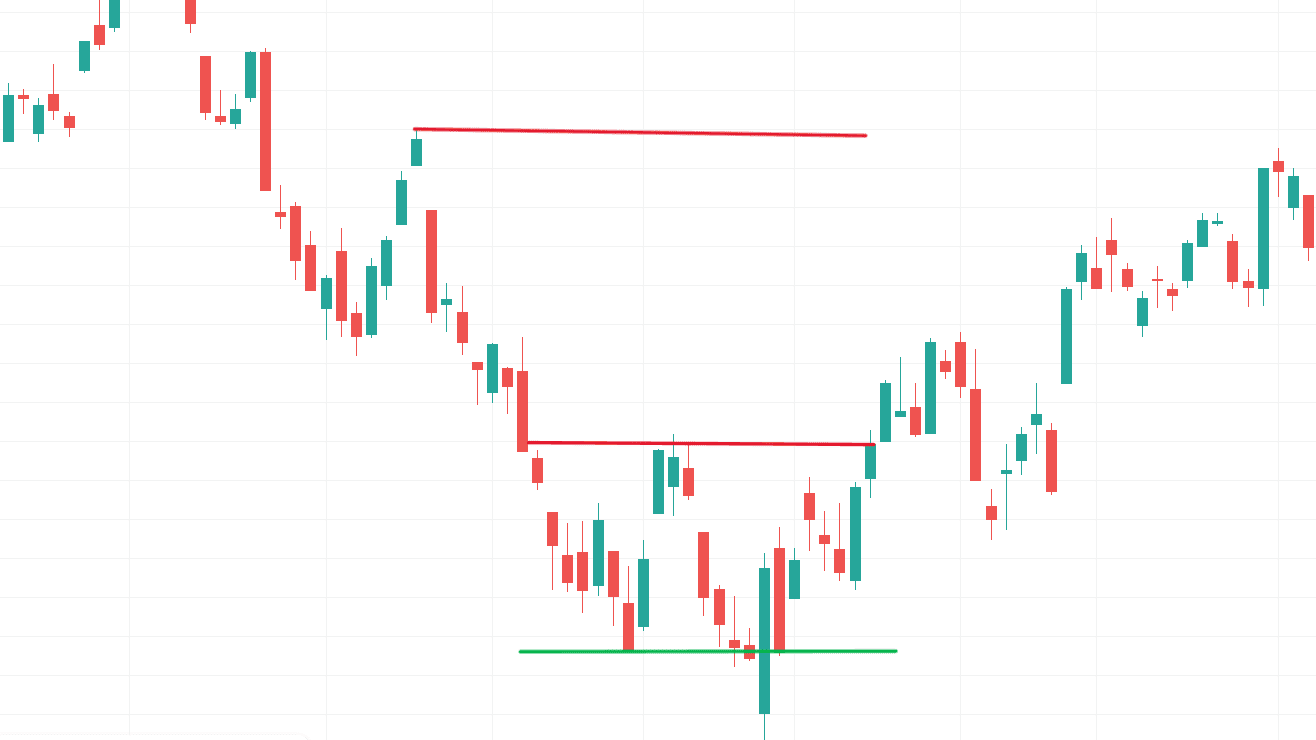

If the market gives a breakout, the breakout level, which worked as resistance previously, will be working as a support, and the stop loss will be there, and if the market reverses, then it will also work as support.

If the market gives a breakdown, if it's reverse, then the breakdown level also works as resistance.

The recent high and low swing works as a support and resistance, where you can put your stop-loss in intraday trading, take small stop losses, and make a massive profit.

Note:- Support and Resistance do not mean the exact level, but they can be, and you have to believe in the reward-to-ratio.