5 EMA Option Trading Strategy

Updated at: 30 May 2024By Deepak PainkraIn this article, we will walk you through 5 EMA trading strategies so that you won't miss any reversal trend, and let's dive into it.

First, let me explain what is the 5 EMA strategy, also, what it stands for,

What is the 5 EMA Strategy?

5 EMA stands for Exponential Moving Average, and it is an indicator which indicates the price EMA. In simple words, it represents the price EMA in the graph. In this article, I will explain to you in detail how to use it and so on,

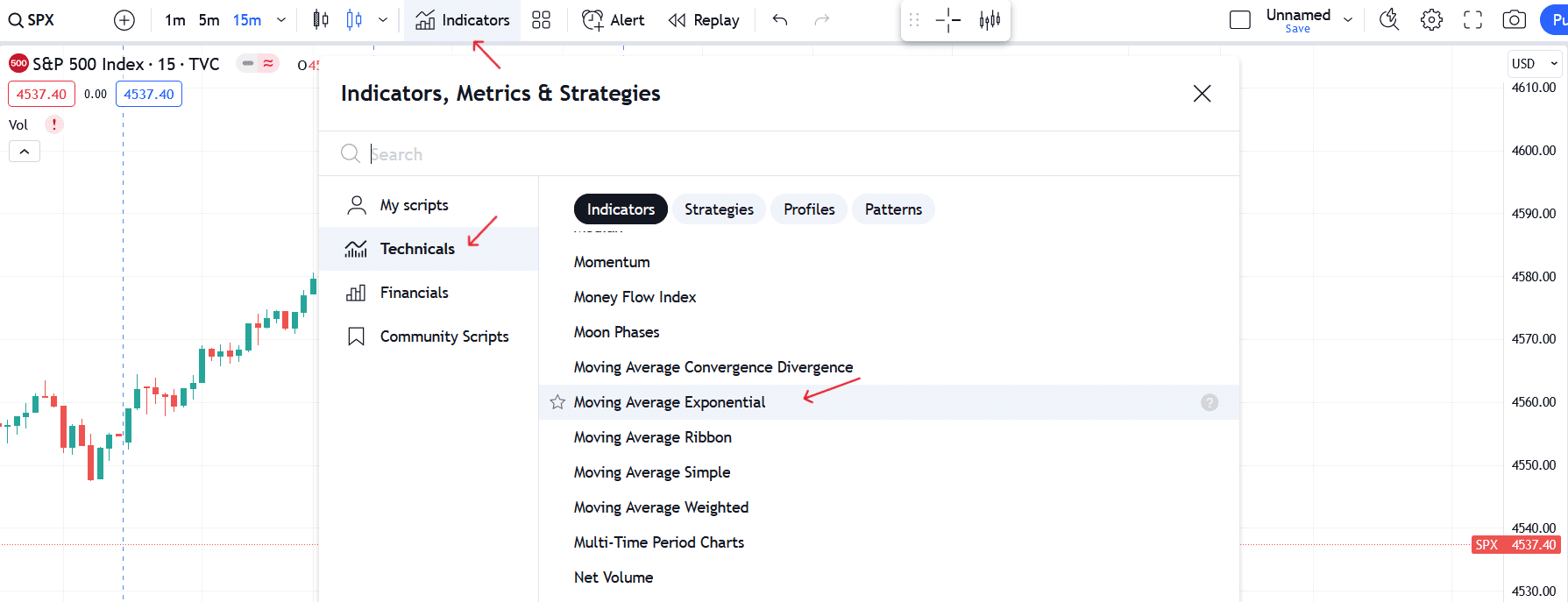

How to Turn on the 5EMA Indicator on TradingView?

To turn on the 5 EMA indicator, first tap on the indicator icon. The next step is to choose the technical, then after the indicator, scroll down a bit and search for the Exponential Moving Average. And here we go, now you will turn on the 5 EMA indicator.

In this image, I have shown you how to do it by yourself, and the time frame will be 5 min,

How 5 EMAs Work in Options Trading?

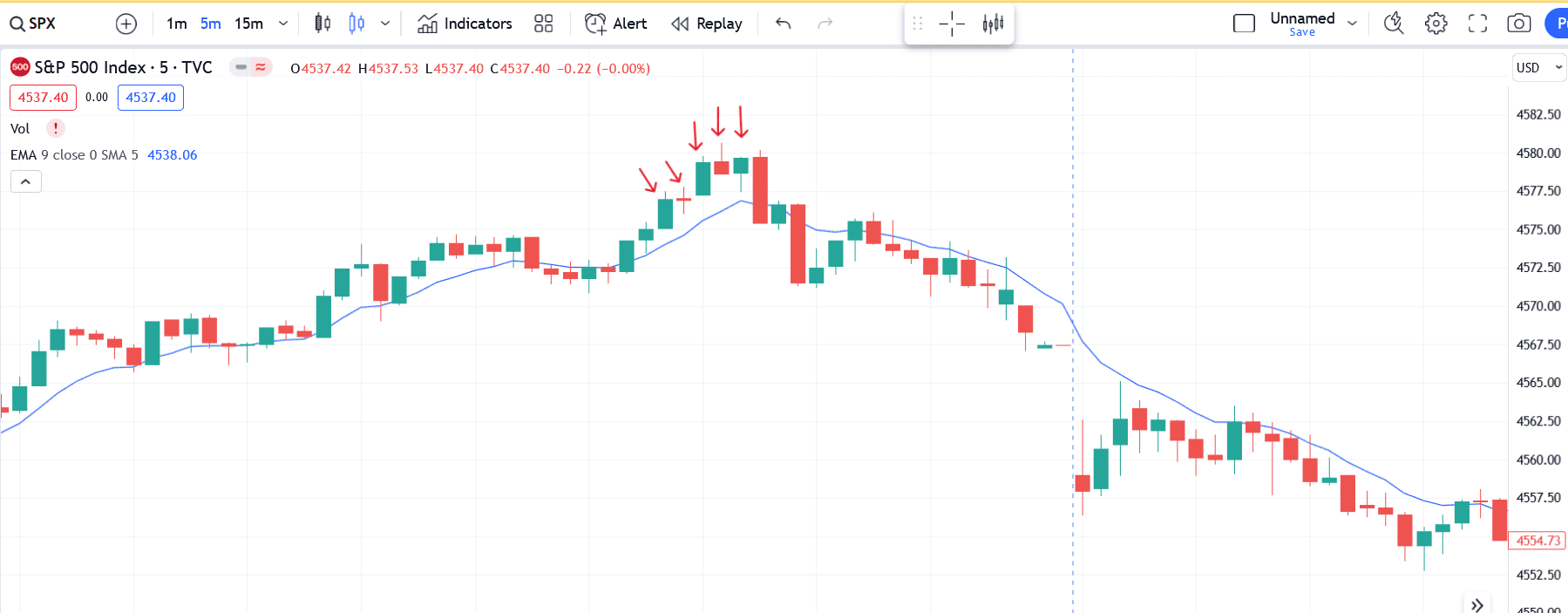

In a 5-minute time frame, if the candle gets formed without touching the EMA, then we can think of sorting the position or buying a put option,

Now, let me explain to you the chart pattern.

This chart pattern shows that the candle closed above the 5 EMA, and it did not touch the line, which you can see on the graph,

Important Points

- The time frame will be 5 minutes.

- Either a red or green candle, it does not matter

- The gap up and gap down acts as a support resistance.

Note:- Stop loss will be their high swing because this strategy has 50-65% accuracy.

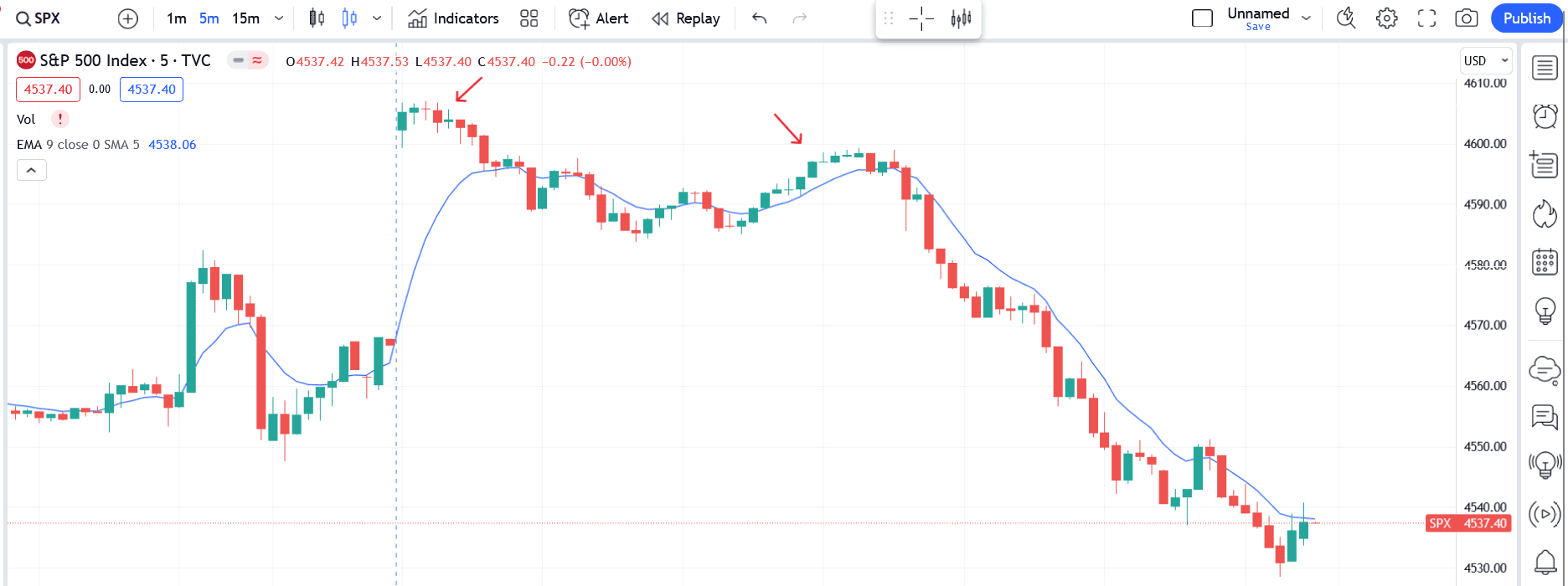

5 EMA Advance Price Action Strategy,

For better understanding, I'm showing you a live example of 5 EMA in the S&P 500,

In this chart pattern, we have found two 5 EMA at the top, which I have marked. Also, you can use this strategy to identify the reversal of the trends.