How to Develop a Trading Strategy

Updated at: 14 Aug 2023By Deepak Painkra

To develop a trading strategy, you must have experience in the market. In this article, I will create a trading strategy and explain you in the chart of the S&P 500.

Developing Own Trading Strategy

So let's first open up the chart pattern of the S&P 500 in trading view, and the time Frame will be 1 hour,

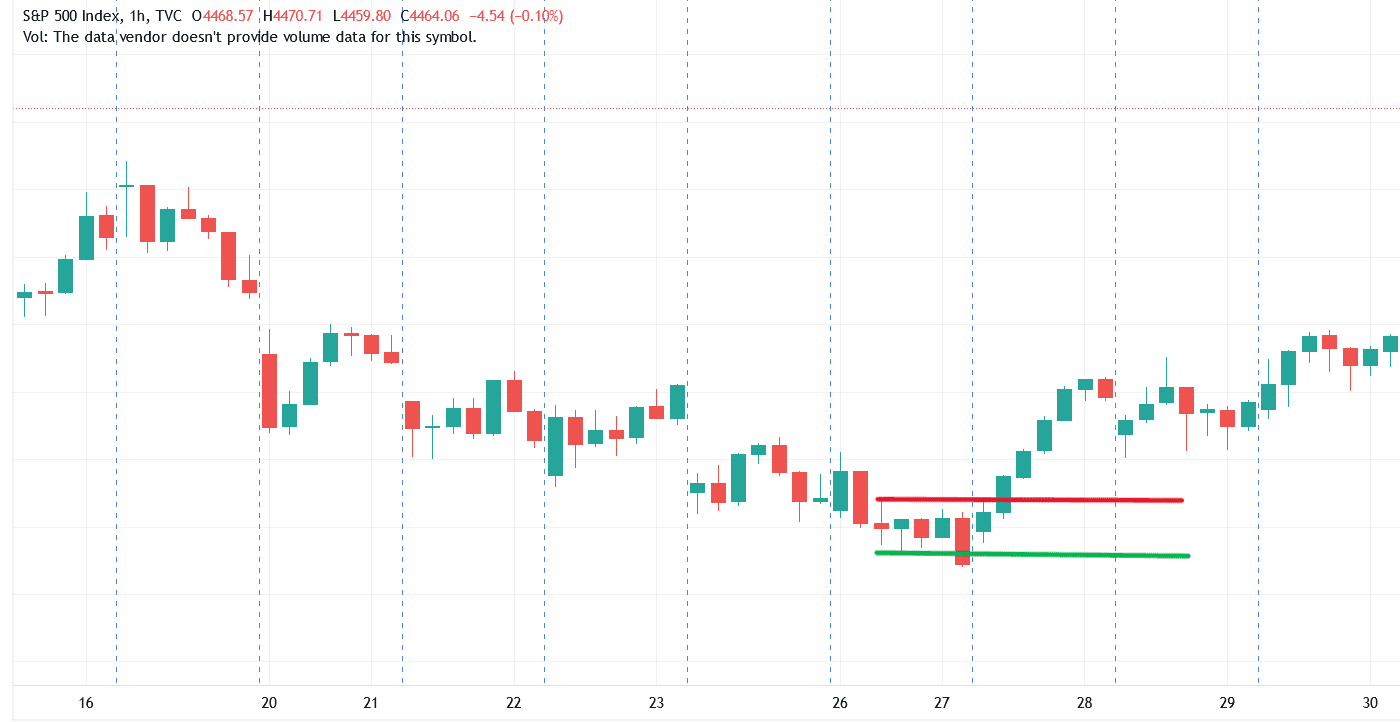

And let me show the chart pattern so that you can have a better idea,

In this image, I have marked a chart pattern, and whenever a candle gets formed in the same range and when its beak the level, it will give a good momentum.

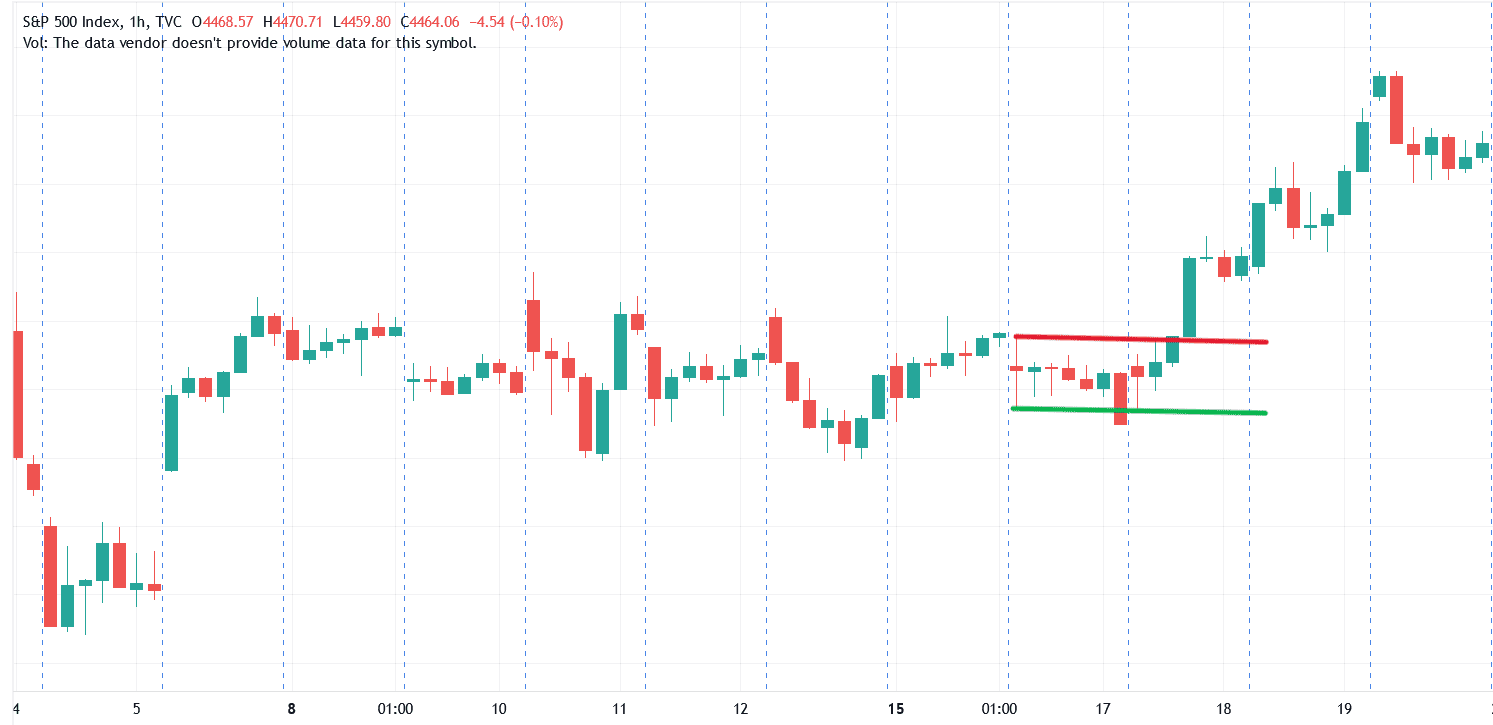

Second Image of the Chart Pattern,

Let me show another example of this chart pattern,

As I have shown you another example of the chart pattern, you can even use smaller or bigger time frames, and it does not even matter, like I have developed my trading strategy so you can too.

This thing required to develop a trading strategy,

- Analyzing the Chart Pattern

- Consistency

- Observer the market while not taking trade

- Develop Trader Mindset

- Try to understand Price Action Behaviour

- Maintaining Risk to Reward Ratio

- Gain Experiences

Understanding the Price Action

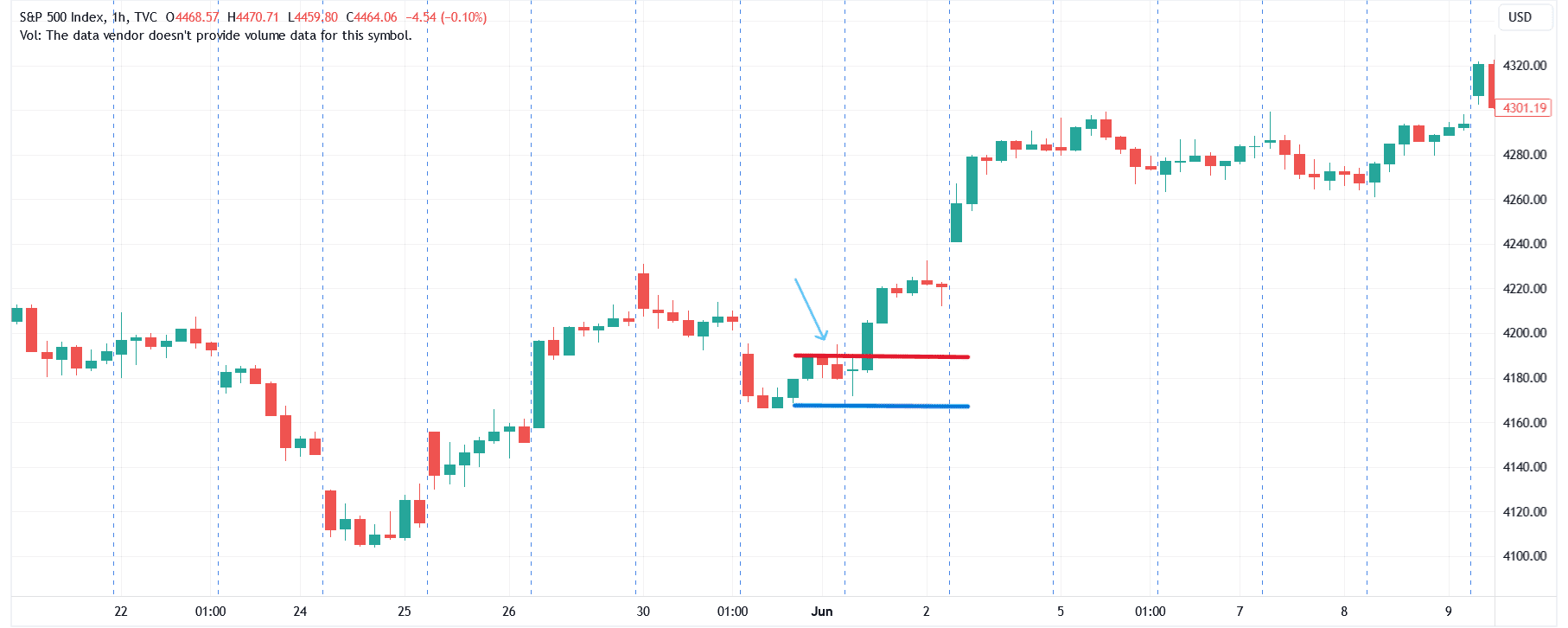

As I have said, it is good practice to understand the price action and let me explain to you in detail.

As I have given a live example in this image, regarding how the price action work, whenever a chart pattern breaks to a certain level, it's retesting again, and if it is not recovering more than 50%, then it can be sustainable, which I have talked about in my others blog.

Price Action Strong Breakout

If you have noticed one thing, whenever a chart pattern creates a pole & flag pattern and goes sideways, in the end, it will give you a strong breakout.

All of these things I have learned while staying in the market, but remember one thing nothing always works a hundred per cent times.