How to Identify Strong Support and Resistance

Updated at: 06 Feb 2024Deepak Painkra

In this article, I will walk you through the strong support and resistance in options trading, and let's find out how anyone can identify the chart pattern.

Table of Contens

First, let me walk you through how this support and resistance works,

How do Support and Resistance work?

When the market gives you a breakout, so many people who missed the opportunity will add their position if the market retests the same level again, and it will create momentum, we can say support.

Note:- When the Market breaks the resistance, if the market reverses, the resistance will work as a support.

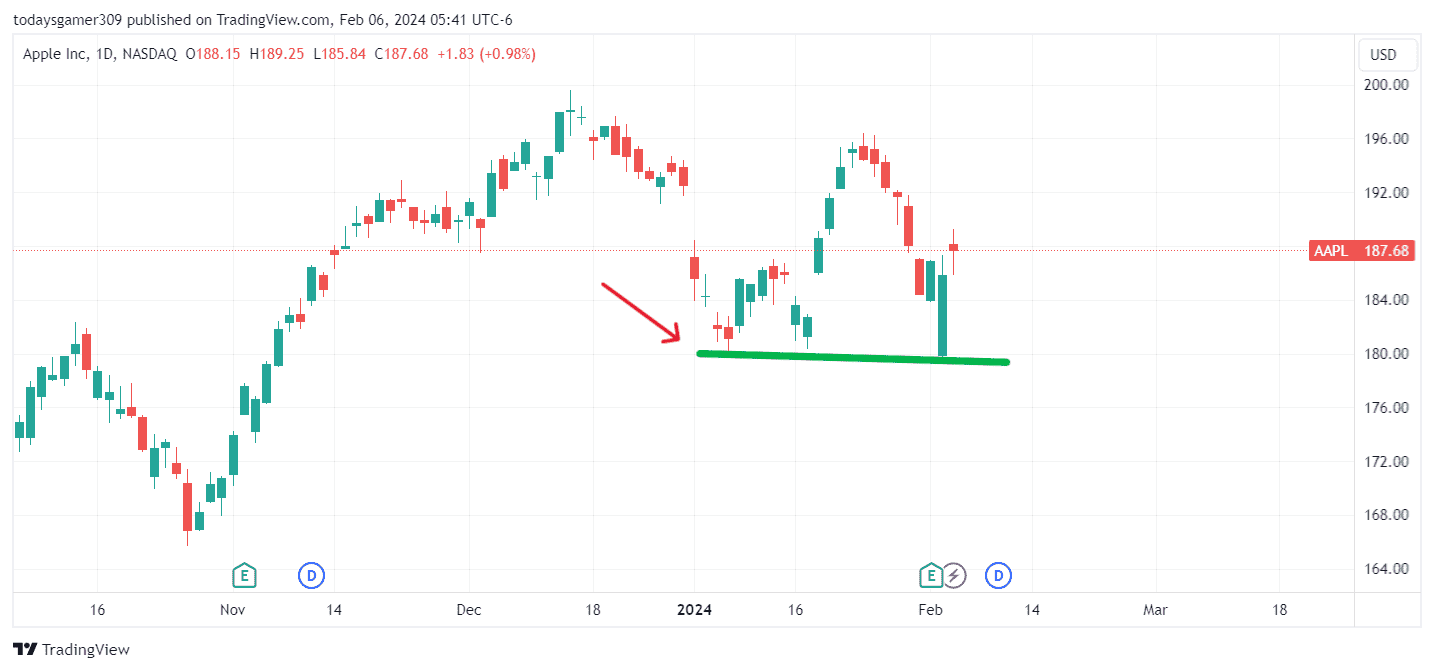

Example of Strong Support and Resistance

I have taken the example of Apple Share, and if the market hits the same level multiple times, it gets weak, but next time, chances are very high that it will break the level.

If the level touches more than three times, chances are high, and it will give you follow-through, and this thing is applicable for both support and resistance in the chart pattern.

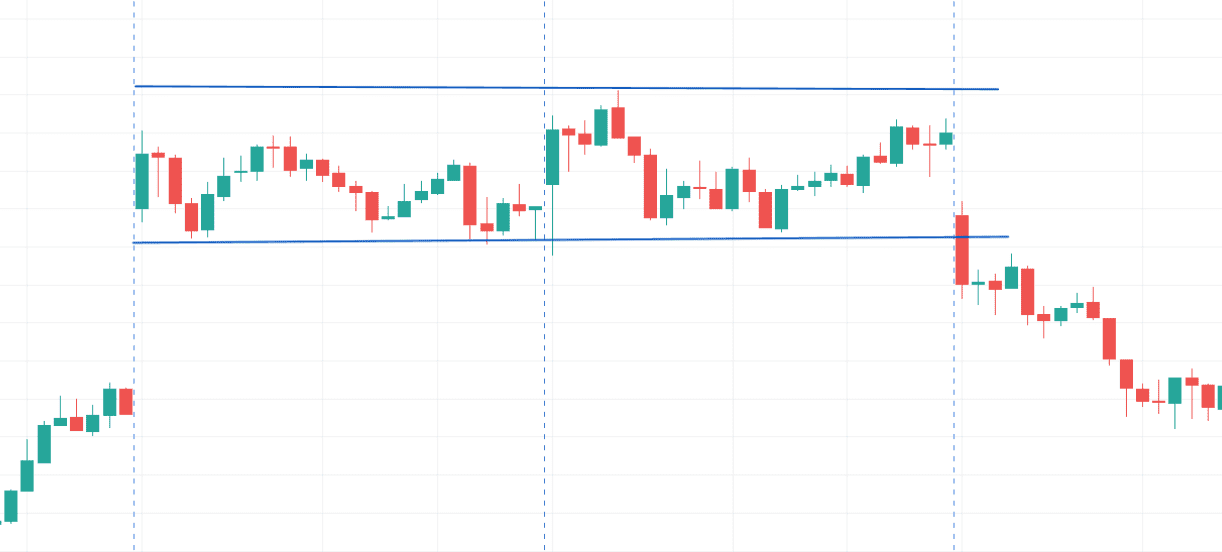

Creates a Channel Formation

First, let's understand the rhythm of the market. Either the market travels in a channel or goes sideways. The previous theory is also applicable to this strategy.

When Chanel gets formed in the chart pattern, then its upper part works as a resistance and the lower part as a support,

Here are the live examples of the channel formations,

You can't predict the exact support and resistance in the market, but it could be that area which creates support and resistance and ensures the price won't hit the same level more than 3 to 4 times. Otherwise, it gets weak.

Market Trades in Range,

The most likely market travels either in a channel or in a range. Whenever it is in this situation, it follows this strategy,

In this chart pattern, if you have noticed, this price action strategy works similarly to the previous one. It is also called the supply and demand zone in trading, where most buying and selling happens.

When the market touches this demand and supply zone again, it will work as support and resistance.

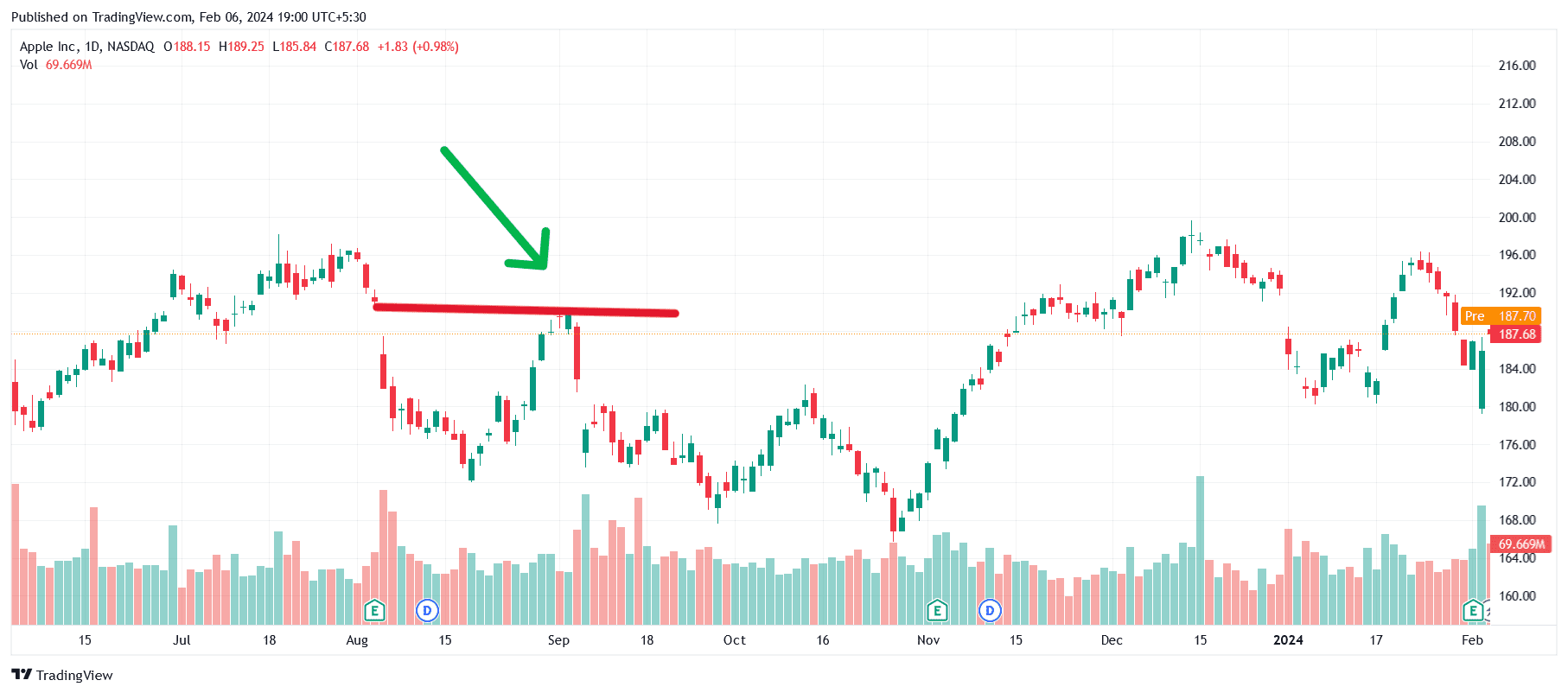

Gap Up and Gap Down Work as a Support and Resistance,

You can find a lot of examples if you detail analyse the market. Let me show the examples in the chart pattern and explain to you how buyers' and sellers' mindsets work,

If you see this Apple share when the market touched the gap down area, it got reversed because it works as resistance, and the same thing also applies to support.