V-Shaped Recovery Trading

Updated at: 07 March 2024Deepak Painkra

Instant recovery pattern, which is V shape recovery, in this article, we will talk about v shape recovery trading and understand the technical of v shape recovery.

First, let's understand the technical of V-shape recovery and try to understand the buyer and seller mindset during V-shape recovery.

What is V-shaped recovery?

If the market continues in the downtrend, and the market changes direction and gives an instant upside move, it creates a shape like a V shape, and it is called a V-shape recovery.

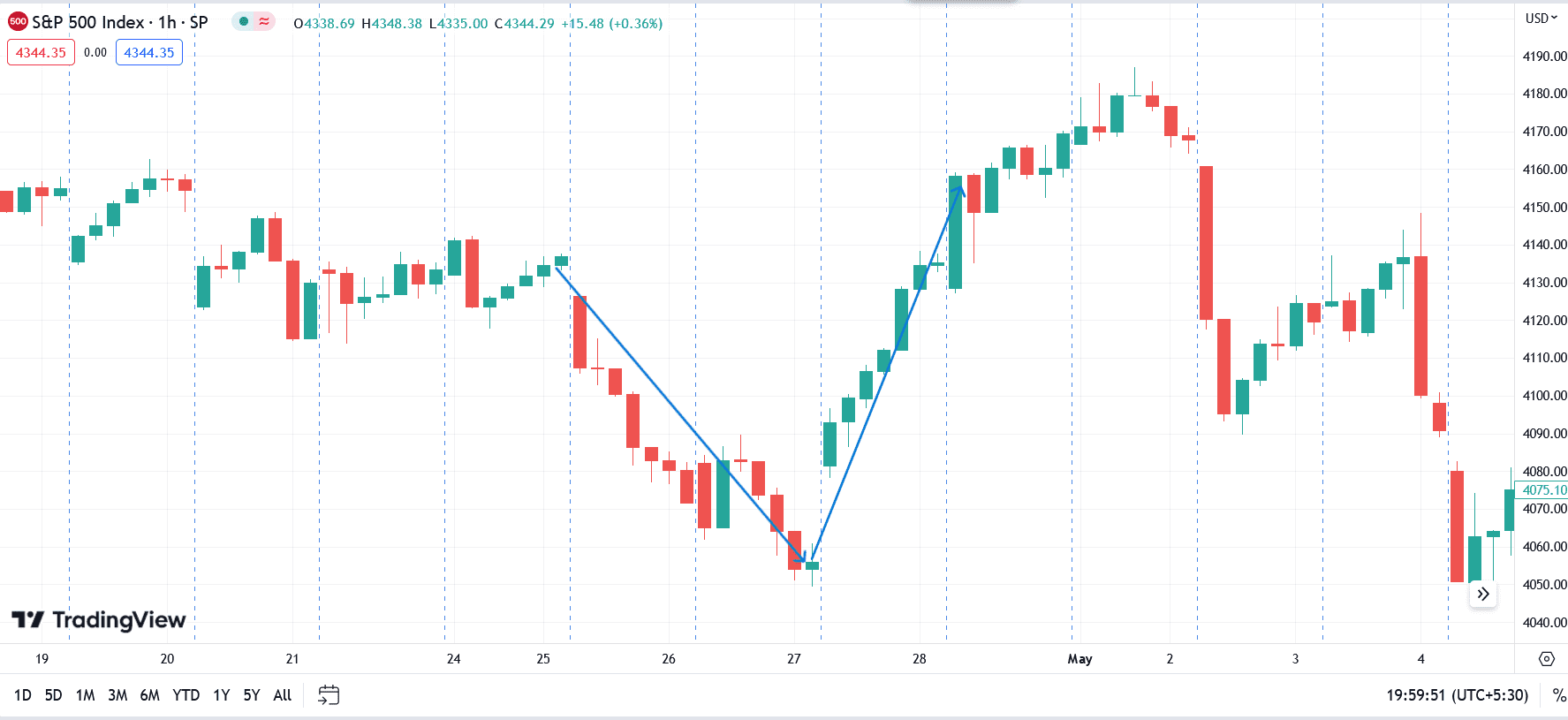

Also, have a look at the chart pattern, and this is how it looks,

Now, let me walk you through why V-shape recovery happens,

Why does V-shaped recovery Happen?

When the market continues in the downtrend, then what do people do? They hold their position for the next day only if they are in a profit of more than 70%-80%. And when the market goes against her, they exit their trade, and the resulting market will go up. It is also called v-shape recovery.

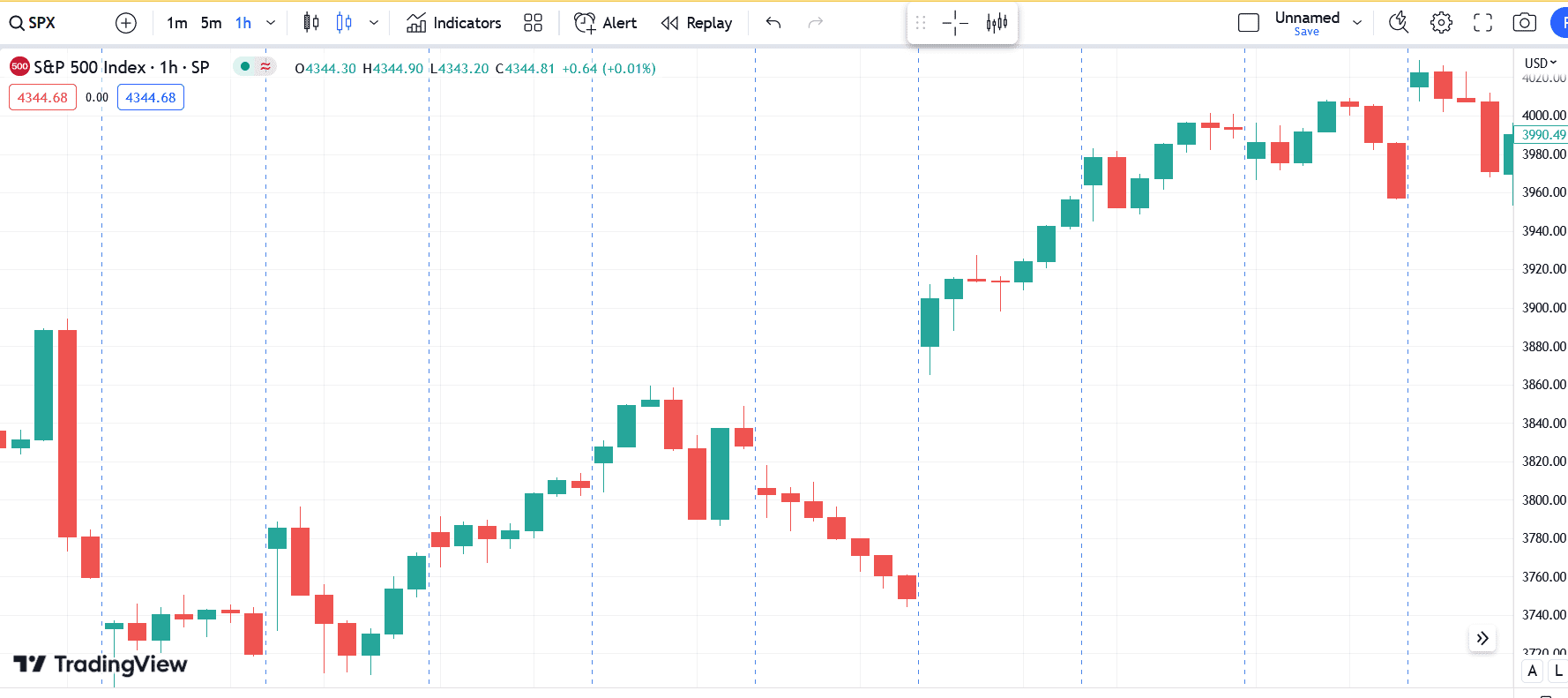

As you can see in the chart, the people who had created their position at the top will indeed exit their trade if the market goes against them.

How to Trade with V-Shaped Recovery?

To trade this in a V-shaped recovery, you have to understand the psychology of the buyer and seller, and as I stated previously, if it's opening a big gap, then all the sellers will exit their position. And the resulting market will go up.

And if the market opens in their favour, then the market goes down a little bit and then people start booking their profit, then the market shoots up upside.

It is significant to hit option seller stop loss so that new buyers will active again, and then the market heads in the up direction,

Another question you must be wondering is how the option seller holds their position for the next day, and the answer is they hedge their position. What do I mean by that, and let me tell you something,

What is a Hedging Position?

Hedging position means if you have already sold any call option and at the same time if you bought a call option for your safety, then it will be called Heding Position,

These are the points to know about heading position,

- Option seller only holds their winning trade if they have more than 70 to 80%.

- Also, they hedge their position because if the next day, the market opens a gap or gap down, so they won't lose lots of money,

- Do not take an overnight position without hedging.

What will be the Time Frame?

It could be any time frame. But a larger time frame will be significant, and this recovery happens when the market is volatile and gives both sides moves, but mostly happens in the Gap Up market if the market's previous trend is downtrend.

Positional trade and Hedge Positions are other topics we will discuss in another blog.